'AITA for reporting my dad for fraud over his $7,000+ credit card debt?'

A woman, who had always followed her parents' advice to build a strong credit score and dreamed of major life milestones like buying a car and home, suddenly found her dreams in jeopardy. After diligently maintaining her credit score, she noticed a sharp decline and uncovered a shocking issue.

It turned out that a credit card, her father’s Discover card, that she thought was simply linked to her account had her listed as the primary account holder, despite her never applying for or signing anything related to it. This discovery has thrown her financial plans into chaos.

Woman shares credit card chaos and how she reported her father for fraud

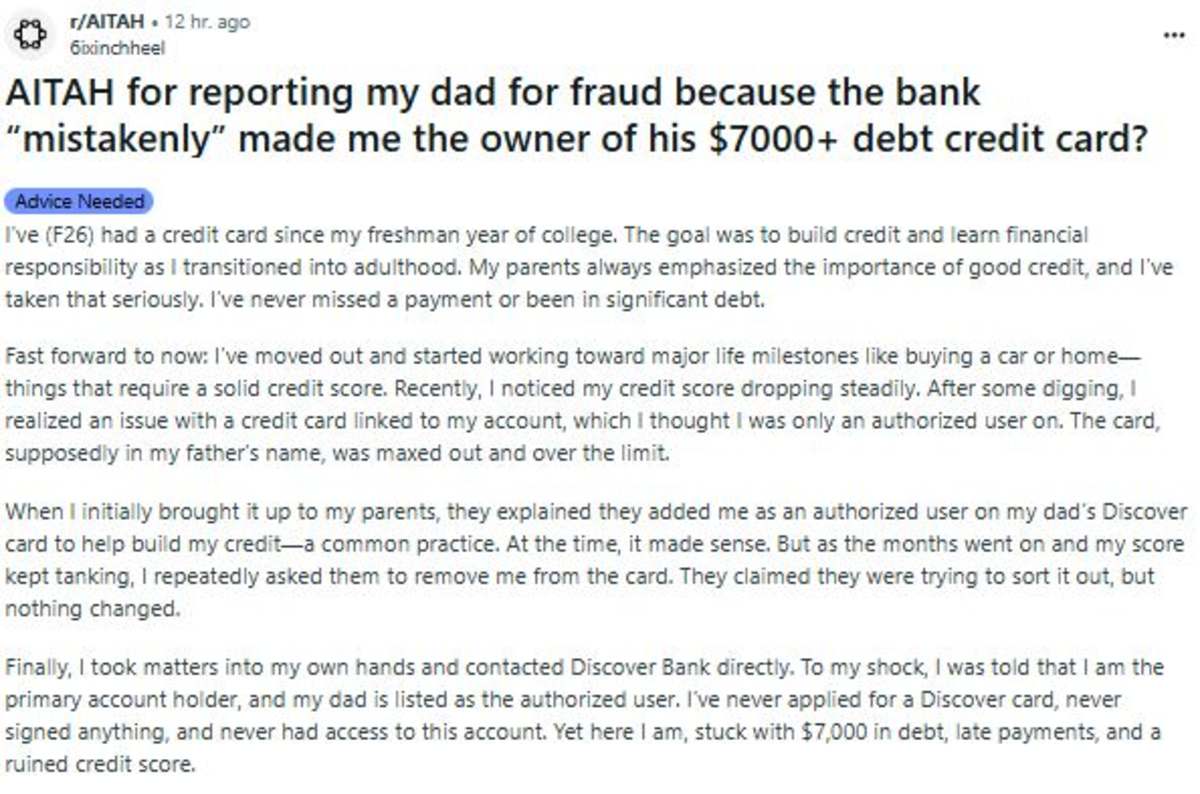

A 26-year-old woman, who has had a credit card since her freshman year of college, shared her story on Reddit's 'Am I The A**hole' about trying to build her credit score, a goal her parents had always emphasized.

Under the pst titled 'AITAH for reporting my dad for fraud because the bank “mistakenly” made me the owner of his $7000+ debt credit card?', the OP said she had been diligently maintaining her credit score, believing it would help her achieve her dreams of buying a car and a home - both requiring a solid score.

However, she soon noticed her credit score was "steadily dropping."

After some investigation, she discovered the cause: "I realized an issue with a credit card linked to my account, which I thought I was only an authorized user on. The card, supposedly in my father’s name, was maxed out and over the limit."

She continued, "They explained they added me as an authorized user on my dad’s Discover card to help build my credit—a common practice. At the time, it made sense. But as the months went on and my score kept tanking, I repeatedly asked them to remove me from the card. They claimed they were trying to sort it out, but nothing changed."

The situation escalated when she contacted Discover Bank, only to find out the shocking truth: "I am the primary account holder, and my dad is listed as the authorized user. I’ve never applied for a Discover card, never signed anything, and never had access to this account. Yet here I am, stuck with $7,000 in debt, late payments, and a ruined credit score."

She then explained the confusion surrounding the account: "Discover couldn’t provide the original application with my signature, but all the contact info (email, phone number, address) was in my dad’s name. That’s odd because if he were the authorized user, why would he have full control over the account?"

Her parents insisted it was a mistake, but she was baffled: "How they didn’t notice this discrepancy for years—especially since only the account holder can make certain requests or changes."

When she confronted her mom, she received a defensive response.

"She got defensive and accused me of suggesting they did something malicious. I want to believe this is just a mix-up, but the lack of clear answers is suspicious. I don’t understand how the card could’ve been “upgraded” or “matured” without my knowledge, and why I was never notified of such a significant change," she said.

Now, the woman finds herself stuck in a difficult position. "Now, I’m stuck in a terrible situation. My credit is in shambles because of this debt I never agreed to, and I don’t know how to fix it. The only option seems to be reporting it as fraud, but if I do that, it could destroy my relationship with my parents. I’m at a loss."

She asked for advice: "AITAH for considering reporting this as fraud? Has anyone dealt with something like this before? I’m desperate for advice on how to navigate this without wrecking my family or my financial future. Any insights would be greatly appreciated. Thank you."

She later updated, saying: "The account is shown as closed on my credit report which is what my dad told me about a month ago when I asked about it again. My mom now says that they are going to work on paying it off but that’s not going to help my score now. I really love my parents and this is the first time something like this has happened because they usually have my best interest at heart."

She concluded: "If it is the mistake of Discover, I know their legal money is a lot longer than my parents so would it even be worth it if they were innocent. I appreciate all of your advice and I’m going to think on this for a few days heavily."

Redditors advised the woman to report her parents

The Reddit post, which was shared just hours ago, has already received hundreds of comments with users sharing their thoughts and perspectives.

One user suggested, "You know how to find out real fast if they did it on purpose? Tell them you've reported it as fraud."

The second person declared, "Your parents committed fraud. They deserve to be investigated."

Another person commented, "You might love them, but why would someone who loves you try to destroy your credit. Or even better, if destroying someone's credit is how your family shows love, then you should go ahead and show your dad what it feels like."

A Redditor said, "Fraud. Report it. NTA."

A comment read, "If they didn't do this on purpose, then they should have no problem with you filing a fraud report. NTA."

This article contains remarks made on the internet by individual people and organizations. MEAWW cannot confirm them independently and does not support claims or opinions being made online