'Should’ve gotten more': Internet abuzz as ex-IRS contractor Charles Littlejohn sentenced to 5 years for leaking Trump's tax returns

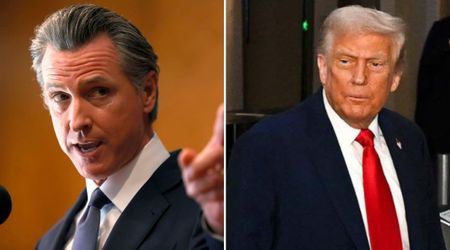

WASHINGTON, DC: In a landmark case, Charles Littlejohn, a former Internal Revenue Service (IRS) contractor accused of leaking tax documents belonging to former President Donald Trump and other affluent Americans, was sentenced on Monday, January 29, to five years in federal prison.

Littlejohn, also known as Chaz, had worked for the tax agency from 2017 to 2021, during which he illicitly accessed and stole tax records of thousands of the country's wealthiest individuals, prosecutors revealed. The stolen information was subsequently handed over to major media outlets, The New York Times and ProPublica.

Judicial condemnation

Judge Ana Reyes, who presided over the case, condemned Littlejohn's actions during the sentencing, asserting that the leak amounted to "an intolerable attack on our constitutional democracy."

"The press tells us Democracy dies in darkness. It also dies in lawlessness," Judge Reyes stated. "There are numerous lawful means to bring things to light. Trump was under no obligation to expose his returns. People could vote for someone else. They could run against him."

Prosecutors expressed the gravity of Littlejohn's actions, stating that they "appear to be unparalleled in the IRS’s history." "[Littlejohn] weaponized his access to unmasked taxpayer data to further his own personal political agenda, believing that he was above the law," they alleged during the trial.

"A free press and public engagement with the media are critical to any healthy democracy, but stealing and leaking private, personal tax information strips individuals of the legal protection of their most sensitive data," they added.

Littlejohn, 38, had pleaded guilty to one count of the unauthorized disclosure of tax return information late last year. In addition to the five-year prison sentence, which stands as one of the largest in a federal leak investigation, he was also sentenced to three years of supervised release, 300 hours of community service, and a $5,000 fine.

Judge Reyes reiterated the prosecutors' sentiments when handing down the sentence, asserting that Littlejohn had carefully planned to violate Trump's privacy over the long term.

"He did not make a snap judgment. He made a series of decisions. This court cannot let others view this conduct as acceptable. I need to send the strongest possible message that we are a nation of laws," she declared on Monday.

Nicole M Argentieri, the acting assistant attorney general overseeing the Justice Department’s criminal division, commented on the sentence, stating, "Today’s sentence sends a strong message that those who violate laws intended to protect sensitive tax information will face significant punishment."

Prosecutors highlighted that the harm from Littlejohn’s disclosures was "so extensive and ongoing that it is impossible to quantify."

Trump, who refused to disclose his tax returns, became the first president to do so since the 1970s. The documents, deemed crucial for understanding his wealth and business practices, garnered immense public interest, prompting the IRS commissioner at the time to order that Trump’s filings be secured in a special vault.

Littlejohn, who had previously worked as a contractor for the IRS, between 2008 and 2013, sought employment there again in 2017 with the specific intention of stealing Trump’s tax records, prosecutors asserted.

The former contractor's actions were characterized as a deliberate effort to "weaponize his access to unmasked taxpayer data to further his own personal, political agenda, believing that he was above the law."

Social media reactions

Following Littlejohn's sentencing, social media platforms were inundated with reactions.

"I'm actually surprised he is getting jail time at all," one posted on X.

"Personally, I think he should have gotten more than 5 years, but at least he's getting some time in prison," another wrote.

"He had a vile intent to act in that way. Should have been a multiplier on the Maximum sentence," someone else added.

"Should’ve gotten more. We all know he’s going to a vacation prison," another chimed in.

I'm actually surprised he is getting jail time at all.

— Mrs Denosko🇺🇸 🌝 (@Denosko1) January 29, 2024

Personally, I think he should have gotten more than 5 years, but at least he's getting some time in prison.

— Dr Vincent Sativa 🇺🇸 (@The_Weed_Shop) January 29, 2024

He had a vile intent to act in that way. Should have been a multiplier on the Maximum sentence.

— Ryan Wasielewski (@R_G_Wasielewski) January 29, 2024

Should’ve gotten more. We all know he’s going to a vacation prison

— Washingtons ghost (@hartgoat) January 29, 2024

A lawyer for Littlejohn, Lisa Manning, argued that her client did not disclose the tax documents for personal gain. Manning stated in a sentencing memo, “He committed this offense out of a deep, moral belief that the American people had a right to know the information and sharing it was the only way to effect change.”

The disclosures fueled longstanding accusations that the tax agency acts with political motivation, a claim that agency officials have consistently refuted. In late 2022, House Democrats on the Ways and Means Committee released six years of Trump’s tax returns following a protracted legal battle, the Times reported.

This article contains remarks made on the Internet by individual people and organizations. MEAWW cannot confirm them independently and does not support claims or opinions being made online.