Jon Stewart schools Bernie Sanders on how government subsidies inflate consumer prices

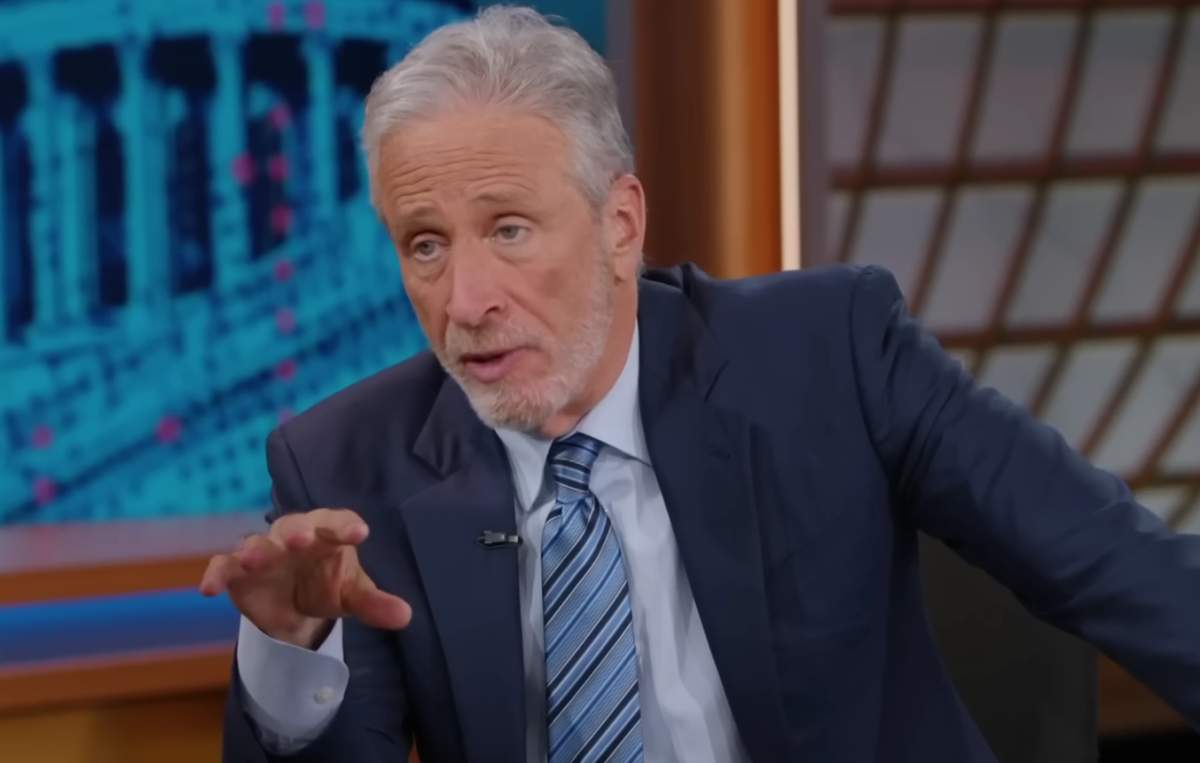

NEW YORK CITY, NEW YORK: Jon Stewart on Tuesday, October 21, highlighted how government subsidies can inflate customer prices to independent Senator Bernie Sanders during an appearance on ‘The Daily Show.’

The discussion centered on the government shutdown, which began on October 1 after the Senate failed to pass a continuing resolution.

Jon Stewart asks Bernie Sanders about subsidy-price-hike problem

Stewart responded to Democrats' call for more than $1 trillion in spending, including increased Obamacare payments. He contended that government spending without cost restraint increases prices for consumers.

"What happens is, when the government promises endless funds to insurance companies or private universities without any cost controls — and Trump seems to understand this — prices rise far beyond the rate of inflation," Stewart told Sanders.

He added, "And we have seen it in tuition, we have seen it in pharmaceutical, and we have seen it in health care."

He questioned the design of the policy, “So my question is, will Democrats recognize the poison pill that they have often placed into well-intentioned policy?”

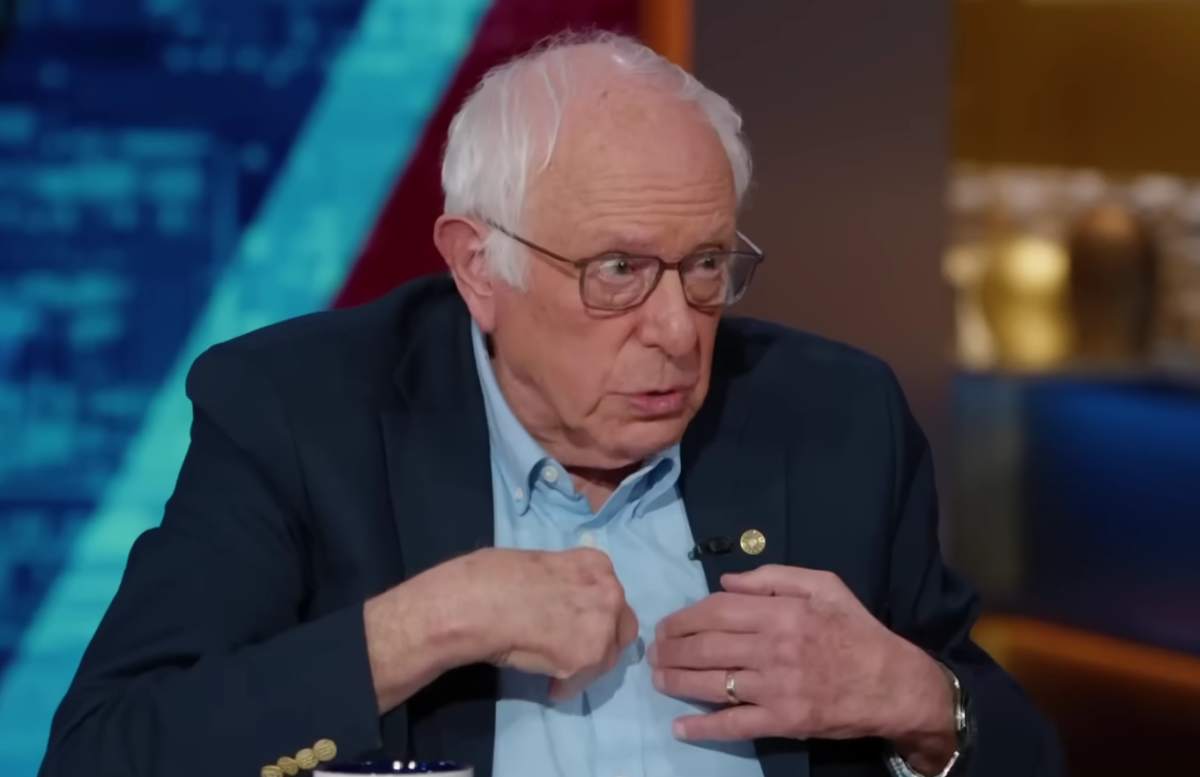

Sanders admitted that policies are frequently too complicated and said, “Right, right. What they end up doing is coming up with very complicated proposals."

He demanded a more straightforward approach and said, “Should health care be a human right? Yes, it should be. Should we have the best quality education in the world, from childcare to graduate school? Yes, we should.”

Federal Reserve Bank of New York study backs Jon Stewart

Evidence backs up Stewart's position regarding price inflation. According to a 2017 Federal Reserve Bank of New York report, for each dollar of federal financial assistance, tuition at colleges went up by 60 cents.

Al Lord, the former CEO of Sallie Mae, conceded in a 2021 interview with the Wall Street Journal that student-loan programs made deep tuition increases possible since the 1980s.

On the other hand, one instance of price cutting without subsidies was at the University of Santa Clara.

When the One Big Beautiful Bill Act limited professional education loans to $50,000, the university raised its financial assistance. It provided a $16,000 scholarship to freshmen, lowering tuition from $63,280 to $47,280, reported Reuters.

Bernie Sanders targets 'oligarchs'

Proceeding to attack the wealthy, Bernie Sanders said, “You know, what we need is a very simple, straightforward agenda, which says — by the way, this is really the sticking point — you’ve got to finally say to the oligarchs, who have never ever had it so good, they are making hand over fist, all right, you got to say to them, ‘Sorry, guys, a billion dollars is enough. You ain’t going to have $200 billion or $300 billion. Try to survive on a mere billion. You will start paying your fair share of taxes!'"

Yet statistics from the Tax Foundation show that the highest 1% income group (those earning $682,577 or more in 2024) contribute a large percentage of the federal income tax.

This income group represented 26.3% of adjusted gross income but reported paying 45.8% of total federal income taxes.