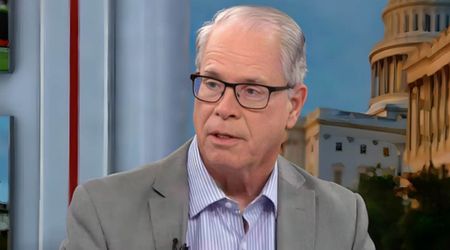

Kevin Warsh nominated by Trump to head Federal Reserve Board

WASHINGTON, DC: President Donald Trump announced on Friday, January 30, that he plans to nominate Kevin Warsh as the next chair of the Federal Reserve, ending a months-long search to replace Jerome Powell. If confirmed by the Senate, Warsh would succeed Powell when his term expires in May.

Trump disclosed the decision in a social media post, praising Warsh’s qualifications and experience. The nomination comes as the Federal Reserve faces heightened political scrutiny and a challenging economic environment.

Kevin Warsh nominated after serving previously as Fed governor

Trump said that he intends to nominate Warsh both to the Federal Reserve’s Board of Governors and as chair of the central bank.

The president made the announcement on social media, writing, “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best.”

Trump added, “on top of everything else, he is ‘central casting’, and he will never let you down.”

A senior administration official told NBC News that Trump met with Warsh in the Oval Office on Thursday and formally offered him the role.

Trump did not reference Powell in his announcement, though the confirmation process is expected to be closely watched due to the administration’s past disputes with the central bank.

Warsh, 55, previously served as a governor on the Federal Reserve’s board from February 2006 until March 2011 after being nominated by then-President George W Bush.

During that period, he represented the Fed at the G-20 and gained experience working with other major central banks, including the European Central Bank, the Bank of Japan, and the Bank of England.

Warsh was also in office during the 2008 financial crisis and oversaw administrative responsibilities at the Fed, including operations, personnel, and financial performance.

Before joining the central bank, he worked at Morgan Stanley in mergers and acquisitions and served as an advisor to companies in manufacturing and technology.

“I hope that my prior experience on Wall Street, particularly my nearly seven years at Morgan Stanley, would prove beneficial to the deliberations and communications of the Federal Reserve,” Warsh said during his 2006 confirmation hearing.

Confirmation process unfolds amid political and economic uncertainty

The position of Federal Reserve chair is among the most influential economic roles globally, with responsibility for setting interest rates, supervising major banks, and managing the US dollar supply.

Members of the Fed’s seven-person board serve 14-year terms, allowing presidents to shape monetary policy long after leaving office.

Warsh was selected from a shortlist that included BlackRock executive Rick Rieder, Fed Governor Christopher Waller, and National Economic Council Director Kevin Hassett.

Trump originally nominated Powell during his first term, while former President Joe Biden renominated Powell for a second term.

Trump’s relationship with the Federal Reserve has been marked by repeated calls for lower interest rates and criticism of Fed leadership.

Those actions, including accusations related to renovations at the Fed’s headquarters and a Justice Department criminal investigation into Powell and the bank, have heightened tensions with lawmakers.