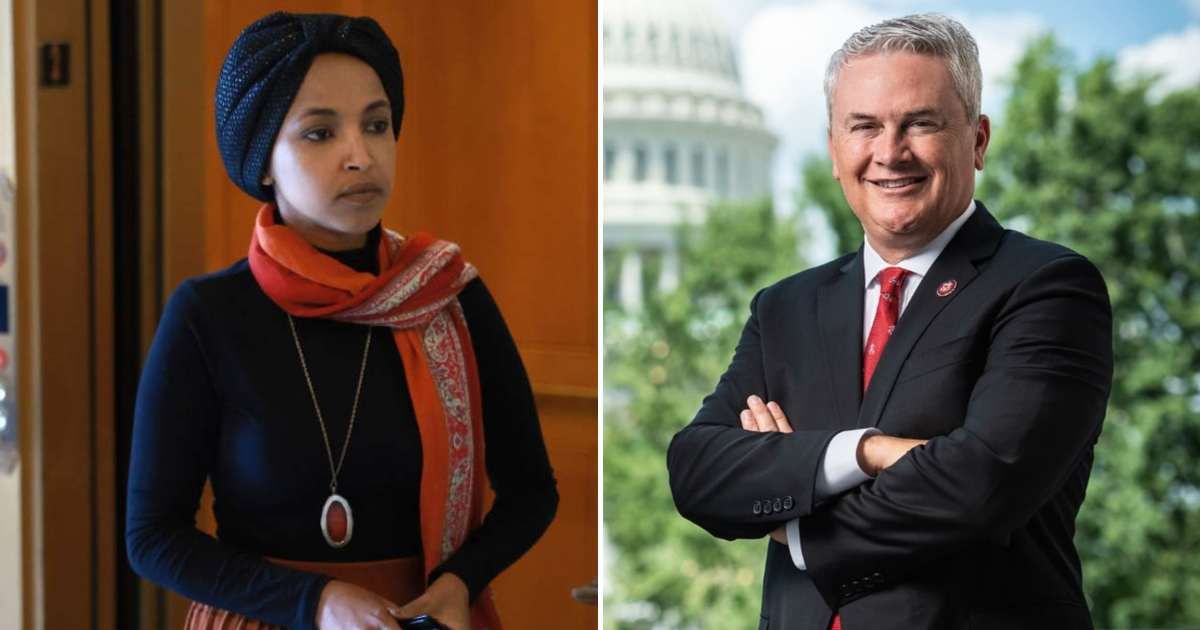

James Comer challenges Ilhan Omar's husband over business records

WASHINGTON, DC: House Committee on Oversight and Government Reform Chairman James Comer (R-Ky) issued a formal request on Thursday, February 5, seeking business and financial records from Timothy Mynett, the husband of Representative Ilhan Omar (D-Minn).

The inquiry centered on what the committee described as a sharp and unexplained increase in the reported value of two companies in which Mynett held ownership interests.

According to disclosure forms filed by Omar, eStCru LLC and Rose Lake Capital LLC were valued at up to $51,000 in 2023. By 2024, those same holdings were listed at as much as $30 million, a more than 140-fold increase within a year.

James Comer questions undisclosed investors behind rising firms

🚨NEW🚨

— Rep. James Comer (@RepJamesComer) February 6, 2026

I’m demanding financial information from companies linked to Minnesota Rep. Ilhan Omar’s husband.

His companies reportedly went from $51K to $30 MILLION in one year — with zero investor information.

So we want to know:

Who’s funding this?

And who’s buying access? pic.twitter.com/mDluOqE9Wg

Comer said that the absence of publicly listed investors or funding sources prompted questions about who was financing the companies and whether those investments could create conflicts of interest.

The firms did not disclose detailed information about their backers or asset portfolios.

“Given that these companies do not publicly list their investors or where their money comes from, this sudden jump in value raises concerns that unknown individuals may be investing to gain influence with your wife,” Comer wrote in a letter to Mynett.

The committee also said that it was examining whether any funds were raised through misleading or improper representations to investors.

Allegations of fraud and distress

The inquiry also referenced prior legal and financial issues tied to Mynett’s winery, eStCru LLC.

In 2021, Mynett allegedly promised an investor a 200% return on a $300,000 investment within 18 months. Court records indicated that the funds were not repaid until after the investor filed a fraud lawsuit in October 2023.

Additional reports from 2024 suggested that the winery faced financial strain and was unable to pay its winemaker in 2023.

Despite those challenges, the company’s valuation reportedly rose by as much as $5 million over the same period, prompting further scrutiny from congressional investigators.

Rose Lake Capital faces scrutiny over disclosure gaps

Rose Lake Capital, Mynett’s venture capital firm, is also under review for limited public disclosure.

The company’s website previously cited five former diplomats with experience in dozens of countries but no longer listed staff names, advisors, or portfolio details.

Comer has requested documents related to travel by individuals affiliated with Rose Lake Capital or eStCru to the United Arab Emirates, Somalia, or Kenya.

The committee is seeking dates, participants, and the stated purpose of any trips connected to business activity in those regions.

Deadline set for financial disclosure

The Oversight Committee has set February 19 as the deadline for Mynett to provide audited financial statements, communications with the Securities and Exchange Commission, and internal records tied to the companies’ finances.

Lawmakers indicated that failure to comply could result in a subpoena.

Omar and Mynett have previously denied wrongdoing. The committee cited its authority under House Rule X to review potential conflicts and ensure compliance with congressional financial disclosure requirements.